california renters credit turbotax

43533 or less if your. You may claim this credit if you had income that was taxed by California and another state.

You paid rent in California for at least 12 the year.

. The rent is paid my dad but my brother and me give him money. Join The Millions Who File With TurboTax. The credit will offset the taxes paid to the other state so you are not paying taxes twice.

I have proof of this through the checks written out to my dad. All of the following must apply. Millionaire taxes would increase 11 in 2023 under House Democrat plan.

House Democrats proposed tax reforms would raise levies for 1 million households by about 11 on average in. The California requirement for renters credit states the person must be living in their primary residence for more than half the. Ad Everything is included Premium features IRS e-file 1099-MISC and more.

Ad With TurboTax Its Fast And Easy To Get Your Taxes Done Right. All Extras are Included. The boost to Californias renters tax credit.

A non-refundable credit worth 60 120 for married joint filers that you can apply to your California income tax if you lived in a rental 4. Check if you qualify. Deductions only reduce the amount of your income that is subject to tax whereas credits directly reduce your.

Your California income was. California Renters Credit SOLVED by Intuit Lacerte Tax 11 Updated July 14 2022 Use Screen 53013 California Other Credits to enter information for the Renters credit. To claim the CA renters credit.

Go to Screen 53 Other Credits and select California Other Credits. Premium Federal Tax Software. In California renters who pay rent for at least half the.

These states have worked out their own formulas for awarding a renters tax credit to eligible tenants. Tax credits generally save you more in taxes than deductions. I dont see anything from the IRS saying there is a limit on how.

Lacerte will determine the amount of credit. A non-refundable credit worth 60 120 for married joint filers that you can apply to your California income tax if you lived in a rental 4. See How Easy It Can Be Today.

Ad CA Tenant Household Information More Fillable Forms Register and Subscribe Now. Check the box Qualified renter. The property was not tax exempt.

Credit Karma Tax Vs Turbotax Which Is Better For Filing Taxes

Turbotax Premier 2021 Federal And State Tax Software Download Target

Simply Too Expensive These Are The Biggest Reasons Renters Aren T Buying Homes Right Now Charlotte Observer

Turbotax Refund Advance Loan Review Credit Karma

How To Get Your Missed Stimulus Payments Nextadvisor With Time

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Can You Pay Taxes With Your Credit Card Nextadvisor With Time

Colorado Inno This Fort Collins Startup Wants To Be The Turbotax For Landlords

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

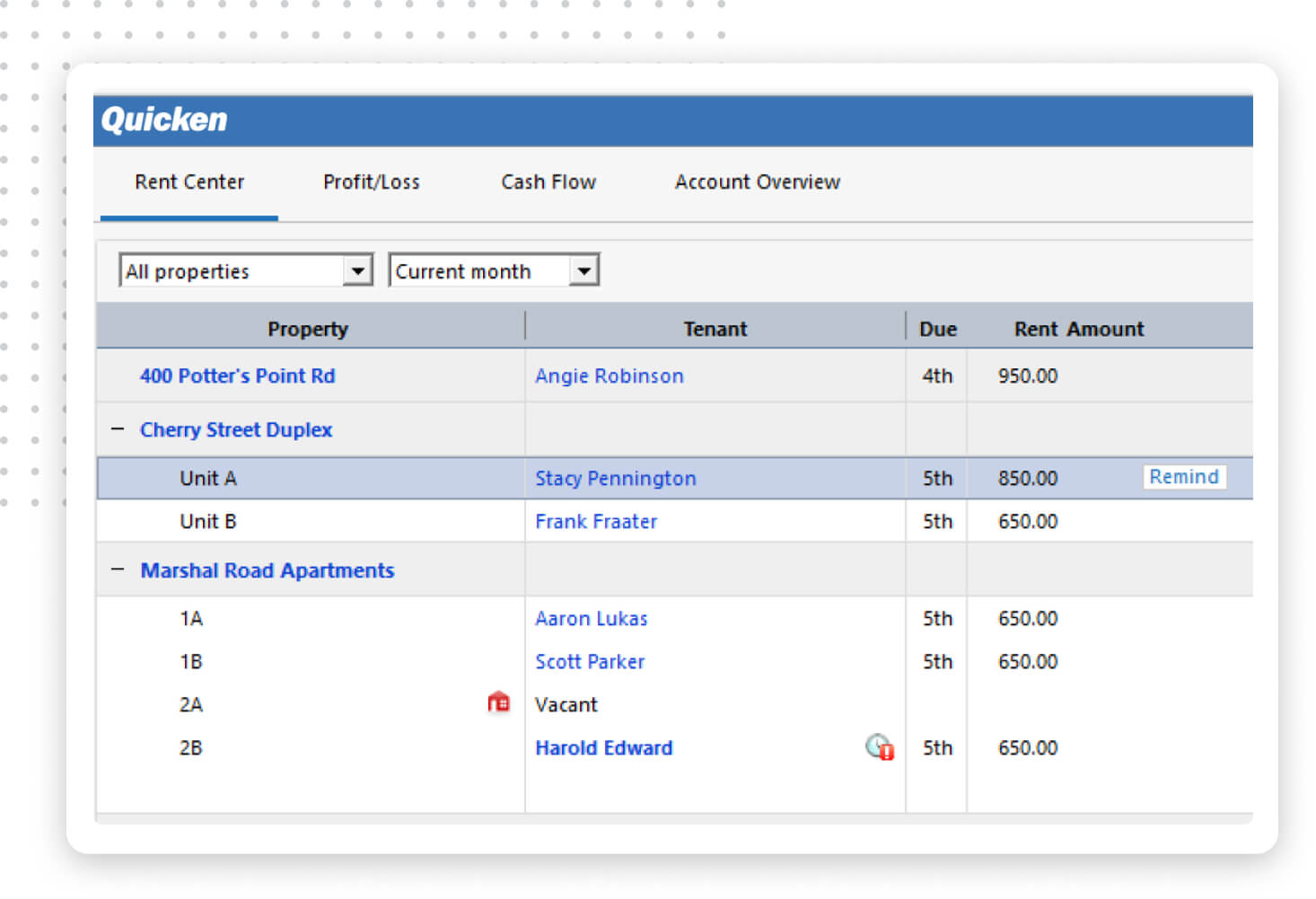

Quicken Rental Property Manager The Easy Way To Manage Your Real Estate

Education Tax Credits For College Students The Official Blog Of Taxslayer

United States How Can I Manually Delete Or Regenerate California Schedule D 540 In Turbotax Personal Finance Money Stack Exchange

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

The Tiny Mistake I Made With Turbotax That Took Hours To Fix

Taxact Vs Turbotax 2022 Tax Software Comparison U S News

Price To Rent Ratio In The 50 Largest U S Cities 2021 Edition Smartasset

Get Your Taxes Done Right With Credit Karma Turbotax

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Nonrefundable Renter S Credit Rental Housing Programs National Low Income Housing